#AI for Stock Trading

Explore tagged Tumblr posts

Text

Discover how to build wealth through stock market investing in your 30s with proven strategies & how AI-powered platforms like Jarvis Invest simplify investment decisions and help you achieve financial freedom with equity advisory services.

#jarvis artificial intelligence#ai for stock trading#share market advisor#best long term stocks#ai stocks in india

0 notes

Text

Top AI-Powered Stock Picking Strategies for Beginners

In the ever-evolving world of investing, technology continues to reshape the landscape, making it easier for individuals to make informed decisions. One of the most exciting advancements is AI powered stock picking, a method that leverages artificial intelligence to analyze vast amounts of market data and identify potential investment opportunities. For beginners looking to navigate the complexities of stock investing, adopting AI-powered strategies can provide a significant advantage. This article explores some of the top strategies for AI-powered stock picking tailored specifically for novice investors.

1. Understanding AI-Powered Stock Picking

What is AI-Powered Stock Picking?

AI-powered stock picking refers to the use of artificial intelligence algorithms to analyze various data sets, including historical stock prices, financial reports, and market trends. These algorithms can identify patterns and correlations that may not be visible to human analysts, providing valuable insights that can inform investment decisions. For beginners, utilizing AI in stock picking can simplify the investment process and enhance the chances of making profitable trades.

Benefits of AI in Stock Picking

The primary benefit of AI-powered stock picking is its ability to process large volumes of data quickly and accurately. Unlike traditional methods, which may rely on manual analysis and subjective judgment, AI can offer objective insights based on data-driven analysis. This capability allows investors to make more informed decisions, potentially leading to higher returns and reduced risks.

2. Fundamental Analysis with AI

Leveraging Financial Metrics

One of the foundational strategies for stock picking is fundamental analysis, which involves evaluating a company’s financial health. AI can enhance this process by analyzing key financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratios, and revenue growth. By using AI tools to assess these metrics, beginners can identify stocks with strong fundamentals that may be poised for growth.

Sentiment Analysis

In addition to financial metrics, sentiment analysis is another critical component of fundamental analysis. AI algorithms can analyze news articles, social media posts, and other public sentiment indicators to gauge market sentiment about a particular stock or sector. By understanding how the market perceives a company, beginners can make more informed decisions about which stocks to buy or sell.

3. Technical Analysis Enhanced by AI

Identifying Trends and Patterns

Technical analysis focuses on historical price movements and trading volumes to predict future stock performance. AI can significantly enhance this analysis by identifying trends and patterns that may be difficult for human analysts to discern. Utilizing machine learning algorithms, AI can analyze historical price data to provide insights into potential future movements, helping beginners make timely trading decisions.

Automated Trading Signals

Many AI-powered stock picking tools offer automated trading signals based on technical analysis. These signals can indicate when to buy or sell a stock, providing beginners with actionable insights without requiring extensive market knowledge. By following these signals, novice investors can capitalize on market opportunities while minimizing the risk of emotional decision-making.

4. Diversification Strategies Using AI

Portfolio Optimization

Diversification is a crucial strategy for managing risk in investing. AI can assist beginners in optimizing their portfolios by analyzing correlations between different stocks and sectors. By suggesting a diversified mix of assets, AI helps investors spread their risk and increase their chances of achieving consistent returns.

Risk Assessment

AI-powered stock picking tools can also evaluate the risk associated with various stocks in a portfolio. By analyzing historical volatility and market conditions, these tools can provide insights into which stocks may pose higher risks and suggest adjustments to maintain an optimal risk-reward balance. This feature is particularly beneficial for beginners who may not have a comprehensive understanding of risk management.

5. Long-Term Investing Strategies with AI

Identifying Growth Stocks

For beginners interested in long-term investing, AI can be instrumental in identifying growth stocks—companies expected to grow at an above-average rate compared to their industry peers. AI algorithms can analyze various factors, such as market trends, competitive positioning, and industry performance, to identify stocks with strong growth potential. This strategy allows investors to build a portfolio of stocks that can appreciate significantly over time.

Dividend Stock Selection

Another long-term strategy is investing in dividend-paying stocks. AI-powered stock picking can help beginners identify companies with a history of consistent dividend payments and growth. By analyzing dividend yield, payout ratios, and financial stability, AI tools can suggest stocks that provide both income and potential for capital appreciation.

6. Continuous Learning and Adaptation

Using AI for Ongoing Analysis

One of the remarkable advantages of AI-powered stock picking is its ability to learn and adapt over time. As market conditions change, AI algorithms can continuously analyze new data and refine their predictions. For beginners, this means that they can rely on tools that evolve alongside the market, providing relevant insights and recommendations.

Educational Resources

Many AI stock picking platforms offer educational resources that can help beginners improve their understanding of investing. These resources may include tutorials, webinars, and articles that explain various investment concepts and strategies. By taking advantage of these offerings, novice investors can enhance their knowledge and confidence in making investment decisions.

Conclusion

AI-powered stock picking presents an exciting opportunity for beginners to navigate the complexities of investing effectively. By leveraging advanced algorithms to conduct fundamental and technical analysis, optimize portfolios, and identify growth and dividend stocks, novice investors can enhance their decision-making processes and potentially achieve better financial outcomes.

As technology continues to redefine the investment landscape, embracing AI-powered strategies can provide a significant advantage. For those looking to enhance their investment strategies and gain deeper insights into AI-powered stock picking, reaching out to Incite Global Inc. can offer valuable guidance and support tailored to individual investment goals. With the right tools and strategies, beginners can embark on their investment journey with confidence and clarity.

0 notes

Text

This informative infographic explains how AI is transforming stock trading through companies like Tradespect. See how advanced algorithms analyze massive data to detect profitable trades in real-time. Learn about the proprietary AI system powering Tradespect's platform and the key benefits of AI-powered trading, including split-second analysis and improved accuracy. Discover how AI is revolutionizing trading and boosting portfolio performance.

#AI Based Stock Trading#trading software#AI Based Trading Software#AI Driven Stock Trading#AI for Day Trading#AI for Stock Trading#AI Powered Stock Trading

0 notes

Text

DeepSeek AI vs Algo Trading: Automate Your Stock Trading Strategies

DeepSeek AI is a low cost Artificial intelligence chatbot Integrating DeepSeek AI with Algo Trading can improve the decision making process in stock market.

Read more..

#deepseek ai#open ai#algo trading india#artificial intelligence#open AI#algo trading#algo trading app#algo trading platform#algo trading strategies#algorithm software for trading#bigul#bigul algo#finance#free algo trading software#ai#stock market#share market#share market news#DeepSeek LLM#DeepSeek Coder#Python#Algorithmic Trading#algorithm#algo trading software india#best algo trading app in india#Best share trading app in India#best algorithmic trading software

2 notes

·

View notes

Text

a weird little thing abt me is i will definitely mock shitty ai art but it never feels right doing it about the hands simply by virtue of the fact that a lot of them look indistinguishable from the hands i was doing years ago when i first got a drawing tablet

#like id have the right number of fingers obv but like. putting the thumb on the wrong side#fingers bending weird directions or connecting in weird places#weird anatomy at joints‚ freaky nails‚ bad proportions‚ bad perspective‚ etc etc etc#people say 'this isnt ai like in sci-fi its just machine learning' but to me its a lot more interesting to look at it as#'this isnt ai like in scifi /yet/'#like yeah the stuff ai does in fiction isnt possible at this point but like. i find it difficult not to wonder if this#is the ai version of infancy stages yknow? like.#ppl go 'its cant write its own stuff its just recycling stuff its been fed' as if thats not kinda how people . learn to talk?#idk i just find it hard to agree with arguments that act like where we currently are at is the furthest these technologies could possibly#evolve in our lifetimes#'it just makes things up' you mean like toddlers going on long winding rambles about unicorns and monsters or w/e#'it cant do art good' you mean like a child? or even just literally Anyone who doesnt know how to draw yet?#like. idk. i feel like people are trying very very hard to insist the ai of today is still the same as it was in the clevverbot days#and that its impossible to evolve any further#people want to cling to the old days when ai stuff didnt pass the turing test by a much wider marging than it tends to now#dont want to admit that it does indeed sometimes surpass the turing test and likely would be able to even moreso were it#not for restraints#(see: that one stock trading ai that did insider trading vs various chatbots not bring allowed to write disparaging things#about copyrighted people or w/e)#if ai stuff was still truly indistinguishable from human works then we wouldnt need to spend so much time#hashtag exposing things as being ai generated#and i just think its bad to‚ in pursuit of that‚ mock things that are like. just stuff all beginner artists struggle with#i guarantee you there is not a single artist out there who hasnt drawn a hand that made them want to curl up and die at least once.#i got very off-topic there but swung it back around at the end there so. hashtag win#origibberish

2 notes

·

View notes

Text

Understanding the Role of AI in Stock Trading

In recent years, the financial landscape has witnessed a trans formative shift, thanks to the rapid advancement of artificial intelligence (AI) in stock trading. AI technologies, including machine learning and algorithmic trading software, are reshaping how investors and traders navigate the complex world of stock markets.

2 notes

·

View notes

Text

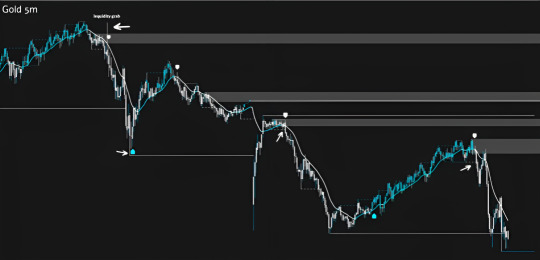

AI-Signals: AI-Powered Buy and Sell Indicator for TradingView

AI-Signals stands as the world’s first AI-powered trading community, committed to nurturing a community of passionate traders. The AI-powered indicator, crafted with cutting-edge machine learning algorithms, takes into account a wide range of parameters to provide the most accurate buy and sell signals. This tool guides traders on the exact moments to enter and exit a trade, thereby facilitating smarter trading.

An integral feature of AI-Signals is the 24/7 AI Trading Chat Bot, available on their website. Trained on AI-Signals data, this chat bot is capable of answering any AI-Signals or trading-related queries. This feature assists traders in their journey towards becoming successful in their trading endeavors. Additionally, AI-Signals hosts a supportive Discord community, filled with individuals who share insights and educational content.

Trusted by traders worldwide, AI-Signals is on a mission to help traders enhance their trading knowledge and skills using AI-powered trading. The AI-Powered Buy & Sell Signals, AI-Powered Auto Order Blocks, and AI-Powered Auto Risk Management are some of the key features of the indicator.

AI-Signals offers two plans: a free Beta Indicator with simple Beta buy/sell signals, and a Full Version at $67 per month. The Full Version includes AI-powered buy & sell signals, AI-powered

risk management, AI-powered order blocks, and VIP Discord Invitations to exclusive events worldwide.

Beta users have already reported significant improvements in their trading. “AI Signals completely transformed my trading game,” said Mike Stuart, one of the first Beta users. “Even during the beta phase, the indicator helped me make profitable trades consistently. I can’t wait to see how the final product will perform!”

With its AI-powered indicator, AI-Signals is poised to transform the trading landscape, making trading more accessible and profitable for traders across the globe.

As part of its commitment to making trading more accessible, AI-Signals is inviting traders to visit their website and try the free Beta Indicator. This is an opportunity to experience firsthand the transformative power of AI in trading. For those who wish to take their trading to the next level, early access to the Full Version Indicator is also available.

About AI-Signals

AI-Signals is the world’s first AI-powered trading community. The company provides an AI-powered buy and sell indicator for TradingView, designed to make trading more profitable by providing precise buy and sell signals. AI-Signals is committed to building a community of passionate traders who are committed to enhancing their trading knowledge and skills using AI-powered trading.

For more information visit:

ai-signals.com

6 notes

·

View notes

Text

5 notes

·

View notes

Text

Are you ready to dive into the world of the Bombay Stock Exchange? This article will explore some of the best companies listed on the BSE, providing valuable insights, analysis, and potential investment opportunities in 2024.

#ai for stock trading#best stock market advisor in india#artificial intelligence stocks trading#AI tool for stock market India#SEBI Registered Investment Advisor#Stock Market Al#Best long term stocks#bse sensex#how to select good stocks#jarvis ai

0 notes

Text

2 notes

·

View notes

Text

AI Trading Assistant: Your New Partner in Market Success

Introduction

In the fast-evolving world of finance, staying ahead of market trends and making informed investment decisions can be a daunting challenge for traders and investors alike. With the rise of artificial intelligence (AI), a new ally has emerged: the AI trading assistant. These advanced tools are designed to enhance trading strategies, providing real-time data analysis, predictive insights, and automated trading capabilities. As more investors turn to AI for support, understanding the benefits and functionalities of an AI trading assistant becomes essential for anyone looking to achieve market success. This article delves into the role of AI trading assistants, exploring how they can transform trading practices and contribute to more informed decision-making.

Understanding AI Trading Assistants

AI trading assistants utilize machine learning algorithms and big data analytics to analyze market data and provide actionable insights. Unlike traditional trading methods that often rely on historical data and human intuition, AI trading assistants leverage vast amounts of information from various sources to deliver real-time analysis and recommendations.

Key Features of AI Trading Assistants

Real-Time Data Analysis: AI trading assistants can process and analyze market data in real time, enabling traders to respond quickly to changing market conditions.

Predictive Analytics: By examining historical data and identifying trends, these assistants can forecast future market movements, helping investors make proactive decisions.

Automated Trading: Many AI trading assistants offer automated trading capabilities, executing trades based on predefined criteria without requiring constant human oversight.

Sentiment Analysis: These tools can analyze news articles, social media, and other sources to gauge market sentiment, providing investors with insights into how public perception may influence stock prices.

The Data-Driven Approach

At the heart of AI trading assistants is a data-driven approach that enhances decision-making through comprehensive data collection and analysis. Here’s how it works:

1. Comprehensive Data Aggregation

AI trading assistants collect data from various sources, including:

Market Data: Real-time stock prices, trading volumes, and historical performance metrics.

Economic Indicators: Information on inflation, employment rates, and interest rates that can impact market dynamics.

Alternative Data: Non-traditional sources such as satellite imagery, web traffic, and consumer behavior data that provide additional context.

2. Advanced Data Processing

Once data is aggregated, AI algorithms analyze it to identify trends and patterns. This capability allows traders to:

Spot potential investment opportunities.

Recognize risks and mitigate them proactively.

Develop more nuanced trading strategies based on comprehensive insights.

3. Actionable Insights

After analyzing the data, AI trading assistants generate insights that inform investment decisions. These insights may include:

Recommendations on specific stocks to buy or sell.

Predictions on price movements based on historical trends.

Alerts regarding significant market changes or emerging news events.

Benefits of Using an AI Trading Assistant

The adoption of AI trading assistants offers numerous advantages for traders looking to enhance their market success. Here are some key benefits:

1. Enhanced Decision-Making

AI trading assistants provide data-driven insights that improve the quality of trading decisions. By relying on objective analysis rather than intuition, investors can make more rational choices, reducing the likelihood of costly mistakes.

2. Increased Efficiency

AI trading assistants can process and analyze data much faster than human analysts. This efficiency allows traders to act quickly on market changes and capitalize on opportunities before they disappear.

3. Reduced Emotional Bias

Emotional decision-making can lead to poor investment outcomes. AI trading assistants operate based on objective data, minimizing the influence of emotions and promoting rational decision-making.

4. Continuous Learning and Adaptation

AI systems continuously learn from new data, allowing them to adapt to evolving market conditions. This dynamic capability ensures that trading strategies remain relevant and effective over time.

Current Applications of AI Trading Assistants

AI trading assistants have already been integrated into various trading platforms and strategies, showcasing their effectiveness in enhancing investment practices.

1. Algorithmic Trading

Algorithmic trading employs AI algorithms to execute trades based on predefined criteria. These algorithms analyze market conditions and historical data to make rapid trading decisions. Companies like QuantConnect and Alpaca are leveraging AI for algorithmic trading, providing powerful tools for investors.

2. Portfolio Management

AI trading assistants are increasingly being used in portfolio management, where they analyze an investor’s financial goals and risk tolerance to create optimized investment portfolios. By continuously monitoring market conditions, these tools help investors maximize returns while minimizing risks. Firms like Wealthfront and Betterment have popularized robo-advisors that utilize AI for effective portfolio management.

3. Risk Management

AI trading assistants can evaluate potential risks associated with specific investments. By analyzing historical data and market trends, these tools help investors identify vulnerabilities in their portfolios and take corrective actions before issues arise.

The Role of Big Data in AI Trading Assistants

Big data is essential to the effectiveness of AI trading assistants. The ability to gather, store, and analyze vast amounts of information from various sources is crucial for training AI algorithms and generating accurate predictions.

Data Sources

Market Data: Real-time stock prices, trading volumes, and historical performance metrics form the foundation for AI models.

Social Media: Platforms like Twitter and Reddit provide insights into public sentiment and trends that can influence stock prices.

News Articles: Financial news and reports contribute to understanding market dynamics and potential catalysts for price movements.

Challenges of Implementing AI Trading Assistants

While the benefits of AI trading assistants are significant, there are challenges that traders must navigate:

1. Data Quality

The effectiveness of AI algorithms depends heavily on the quality of the data used for training. Inaccurate or biased data can lead to flawed predictions, making data integrity a critical issue for successful AI-driven trading.

2. Market Volatility

Financial markets are inherently unpredictable and can be influenced by numerous external factors, such as geopolitical events and economic shifts. AI models may struggle to adapt to sudden changes in market conditions, potentially leading to losses.

3. Regulatory Concerns

As AI becomes more prevalent in trading, regulatory bodies are increasingly scrutinizing its use. Navigating compliance with ever-changing regulations while leveraging AI tools can be a complex challenge for investment firms.

The Future of AI Trading Assistants

The future of AI trading assistants looks promising, with several trends likely to shape the investment landscape:

1. Increased Personalization

As AI technology advances, investors can expect increasingly personalized investment strategies tailored to their unique preferences, risk tolerances, and financial goals. This level of customization will enhance the overall investment experience.

2. Integration of Alternative Data

The integration of alternative data sources, such as satellite imagery and web traffic, will enhance AI’s predictive capabilities, providing investors with a more comprehensive view of market trends.

3. Improved Human-AI Collaboration

Rather than replacing human analysts, AI is expected to augment their capabilities. Investment professionals will increasingly rely on AI tools to enhance their decision-making processes, combining human intuition with machine-driven insights.

4. Ethical Considerations

As AI plays a more significant role in investing, ethical considerations surrounding data privacy, algorithmic bias, and transparency will need to be addressed. Responsible AI use will be essential to maintain trust in financial markets.

Case Studies of Successful AI Trading Assistants

Several firms have successfully implemented AI trading assistants, demonstrating their effectiveness in transforming investment strategies.

1. BlackRock

BlackRock, one of the world's largest asset management firms, has integrated AI into its investment strategies. By leveraging AI for risk assessment and portfolio optimization, BlackRock has enhanced its decision-making process and improved returns for clients.

2. Goldman Sachs

Goldman Sachs employs AI-driven tools to analyze market data and generate insights for its trading desks. By utilizing AI for faster and more accurate analysis, the firm has improved its trading strategies and enhanced client offerings.

Conclusion

The integration of AI trading assistants represents a significant advancement in the financial landscape, empowering traders and investors to make smarter, more informed decisions. As firms like InciteAI continue to innovate and provide powerful AI-driven solutions, the benefits of leveraging these tools become increasingly apparent. By acting as a new partner in market success, AI trading assistants help unlock the potential of data-driven decision-making, enabling investors to navigate the complexities of financial markets with confidence. Embracing these advancements will pave the way for a new era of intelligent trading, where informed decisions lead to sustained success in an ever-evolving market environment.

0 notes

Text

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team.

DeepSeek AI is an artificial intelligence chatbot developed by a Chinese AI team. DeepSeek AI Models can also benefit stock market traders in many ways.

Read more...

#DeepSeek AI#Open AI#Stock Market#Algo Trading#Artificial Intelligence#DeepSeek LLM#DeepSeek Coder#Python#bigul#best algo trading app in india#bigultradingapp#bigulalgo#algo trading software india#ipo alert#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#investment#investmentplatform#algotrading

2 notes

·

View notes

Text

Artificial intelligence stock trading Plateform | Best Ai Trading Plateform for UAI Token Farming, forex trading And options trading

Unstoppable AI is revolutionizing the world of AI-powered trading by combining artificial intelligence, blockchain technology, and AGI (Artificial General Intelligence) to deliver unmatched tools for stock trading, forex automation, crypto trading, Options Trading and algorithmic trading strategies. Whether you're a beginner or an expert, Unstoppable Ai trading offers real-time market analysis, predictive insights, and automated trades to help you outperform the market. Earn passive income through UAI token farming, optimize your portfolio with 24/7 AI portfolio management, and trade confidently with military-grade security and GDPR-compliant data protection. With support for stocks, forex, crypto, NFTs, and derivatives, Unstoppable AI is your all-in-one solution for AI-driven investing. Start at www.uaitrading.ai and unlock the future of smart trading!

#Artificial intelligence stock trading#AI options trading#best AI for forex trading#AI stock trading#AI algorithmic trading#AI for forex trading#AI in forex trading#trading with ChatGPT#forex artificial intelligence

1 note

·

View note

Text

How the Hype Around Chinese AI Model DeepSeek Triggered a Massive Nasdaq Sell-Off

#nasdaq index#sp500#dow#nasdaq today#s&p#nvdia stock#sp 500#dow today#s&p 500#nasdaq composite#vistra stock#s&p 500 today#s&p 500 index#stocks today#why is nvidia down#$nvda#djia#finance#s&p500#constellation energy stock#dow jones#nvidia share price#meta ai#meta stock price graph#djia today#broadcom#ge vernova#why is the stock market down today#us stock market#premarket trading

0 notes

Text

Discover the pros and cons of long term investing vs short term investing and Learn how best stock advisor in India, like Jarvis Invest, can guide your investment decisions.

#ai for stock trading#best long term stocks#stock advisory company#AI Financial Advisor#stocks for long term#stock portfolio builder#short term stock trading

0 notes

Text

Explore the transformative power of AI in stock trading. From advanced AI stock trading apps and bots to predictive analytics, discover how AI boosts decision-making, optimizes investments, and elevates trading efficiency. Uncover the best AI-powered trading platforms, apps, and software shaping the future of Fintech.

0 notes